Welcome

NEW TAXPAYER BENEFITS for Tax Payers & Businesses

- Did you know; After a pause for Covid & short staffing, the IRS is resuming sending automated audits, Letters & collection notices?

- Also Identity Theft cost 50 Billion Dollars a year.

EVERY tax return we prepare comes with;

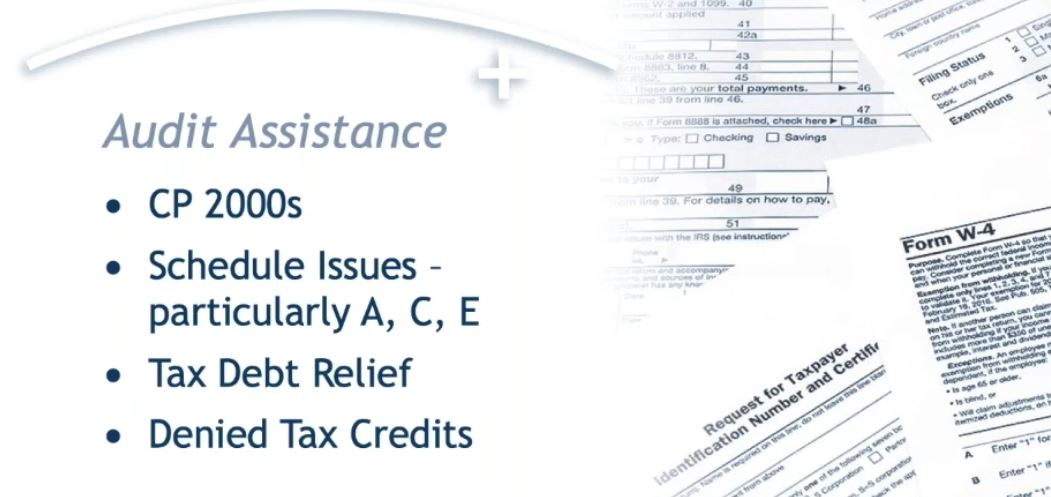

$1 Million Dollars of Audit assistance

Identity Theft Restoration

&

A $2,500 Tax Preparation Guarantee

Tax Preparation Guarantee,

Reimbursement for added expenses incurred due to legitimate

preparer errors up to $2,500. Subject to terms & conditions.

-

Tax Fraud Assistance,

-

In the case of a suspected tax fraud incident, a team of experts assist in completing all required paperwork to get the taxpayer’s tax return successfully filed. We will also help to obtain an IRS Identity Protection PIN in these cases. Subject to terms & conditions.

-

- Audit Protection.

-

- Access to an entire team of experienced tax professionals offering expert assistance with interpreting and resolving federal and state audits and inquiries. Interpretation, Guidance & Professional case assessment and personalized recommendations from credentialed specialists. Subject to terms & conditions.

- Access to an entire team of experienced tax professionals offering expert assistance with interpreting and resolving federal and state audits and inquiries. Interpretation, Guidance & Professional case assessment and personalized recommendations from credentialed specialists. Subject to terms & conditions.

-

- Taxpayers want to know they have help if they receive a letter from the IRS or state. You’ll have access to professional case resolution managers who are here to assist taxpayers all year long!

- Tax Debt Relief, Help with identifying and resolving debt owed to the taxing authorities.

- ID Theft Assistance, Comprehensive, personalized recovery services for identity theft incidents. Subject to terms & conditions.